The use of Trusts in Wills is

an important part of Estate planning.

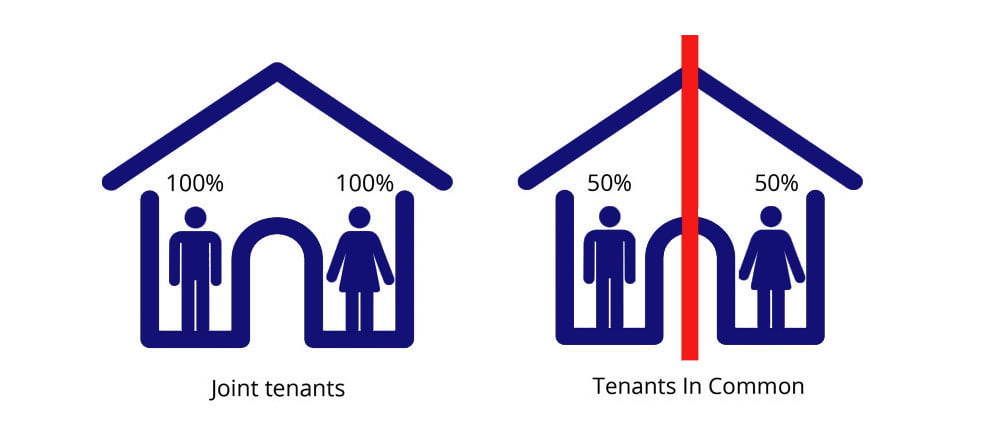

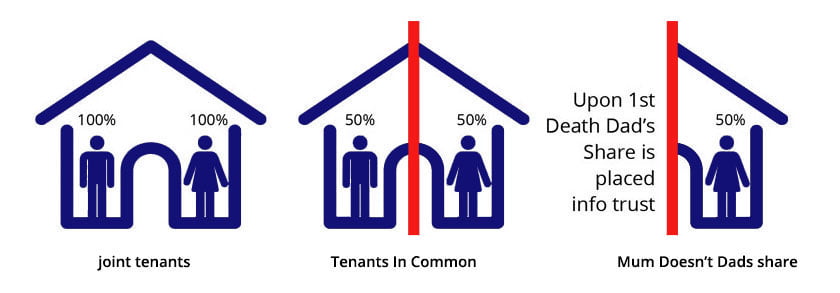

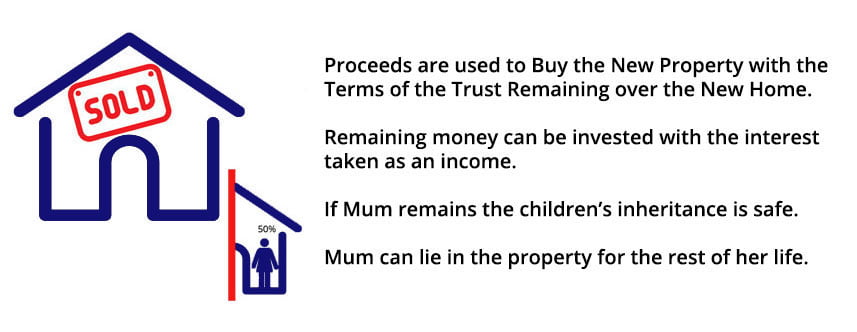

Each co-owner writes a PPT Will. In PPT Wills each co-owner leaves their share of the house to a Trust (technically a life interest trust). The beneficiaries of the Trust are the children (or other nominated beneficiaries), but the Trust gives the surviving co-owner the right to live rent-free in the deceased co-owner’s share of the house (the surviving co-owner is known as the “life tenant”) for as long as they like. If the life tenant remarries or goes into care, the deceased co-owner’s share is protected and goes to the children (or other beneficiaries) when the surviving co-owner dies. A PPT Will can also protect your share of the property for children of a previous relationship.

Property Protection trust

How a protective trust works

The gift of the property into a trust counts as a gift to the life tenant for Inheritance Tax (“IHT”) purposes, and so if the life tenant is a spouse or civil partner this does not use up any of the deceased co-owner’s Nil Rate Band (“NRB”) for IHT purposes (currently £325,000 2011/12). This is important under the new transferable NRB rules.

It is possible to protect assets other than the family home. If instead of leaving these assets to a partner, these assets are left in a Flexible Life Interest Trust (“FLIT” – technically a defeasible life interest trust) for the surviving partner the surviving partner is allowed to have an income from these assets but not the capital (which typically passes to the children on the death of the surviving partner).

One advantage of this arrangement is that if the surviving co-owner goes into care their share of the house only will be assessed. Under current guidelines (Charging for Residential Accommodation Guide (“CRAG”) published by The Department of Health), the surviving co-owner’s share of the house will be valued at less than his/her share because the market value of the house will be reduced due to the nature of the ownership. A 10% reduction will be applied (to allow for the costs of selling) and, in fact, the value of the share may very well be nil (CRAG paragraph 7.014).